Etoro & Taxes (Updated)

A quick guide for how to get the information you need on Etoro to do your taxes

Hello Everyone,

This is an updated version of the previous tax guide. I have created an update as Etoro has changed their site to make this process more convenient as well as to add more forms for Etoro users to download. The instructions are relevant to 2021 taxes but you can adjust the time frame to whichever year you would like.

How to get your tax forms from the Etoro site

Options for filing the information

How to get your tax forms from the Etoro site

Sign in to your Etoro account

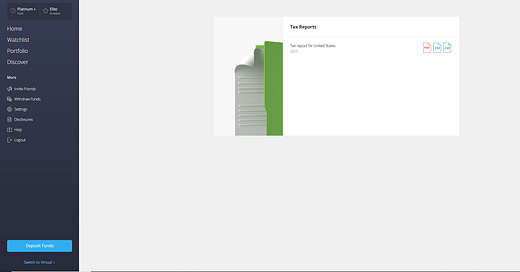

Go to this URL: https://www.etoro.com/documents/taxreport

Click PDF, TXF, & CSV depending on which format you would like your information.

Depending on which tax software your tax professional uses they may prefer CSV or TXF so you should check with them (different tax softwares might only accept one of the 2 file types). The PDF is the only one of the three that has summarized information for your 1099-B & 1099-K so I would recommend downloading it.

Next you will want to go to this URL: https://www.etoro.com/documents/accountstatement

Select the “Last Year“ option

Then click “Create”

You have now generated your Etoro Account Statement for the year of 2021 (assuming it’s currently 2022). You can provide this summary to your accountant or tax software. If you would like the raw data of your transactions Etoro provides it in the top right via the “xls“ & “PDF“ icons.

Some of this information may be redundant with the other files Etoro has provided but each has information summarized in different ways so I would recommend bringing both(the account statement & the tax reports generated by Etoro).

Options for filing the information

In terms of using this information to file your taxes, you can use software (Crypto specific) that Etoro previously sent out to users in an email last year (featured below)

This is a link to a webpage version of this email: LINK

I haven’t used these software’s prior so I can’t vouch for or against them but as they were sent out by Etoro I am working under the assumption they are compatible with their raw data (Would recommend checking with Etoro support/the sites help area before paying for there services in case this has changed). Etoro also provided this article on taxes which has the discount links + more crypto tax info LINK. I would like to note that the discount codes have likely expired.

Another option (the one I take) for filing is to work with a tax professional, provide them your tax info and pay them to process it. One issue with this approach is that not all tax professionals will be comfortable with Crypto tax data or with Etoro’s tax data format. Due to this, I checked with the tax professional I work with(who has done my taxes, crypto taxes, & Etoro specific taxes) & he said he would be happy to take on clients with crypto tax needs. His information is as follows:

His contact information & location:

David Lowry, EA

13 Fairfield Ave STE 206

Little Falls NJ 07424

www.davidlowrytaxservice.comHe is comfortable handling general taxes, any 1099-s related to crypto transactions, Crypto Sale transaction information for sites like ETORO, & Crypto sale transaction information for any other Crypto Transactions.

He has 10 open slots for clients who he would be able to meet with during late March or April

He is willing to handle taxes for US residents of NY, NJ, PA, & any other states that don’t have state income tax

He is offering $20 off of this year’s tax filing for any new clients with crypto-related taxes who mention this article/my Etoro page

Two things I would like to note regarding the above:

Full disclosure I am not receiving anything from this referral, if I mention a service at any point & am receiving an incentive of any kind I will mention it to make you all aware.

Even if you don’t match the above locations/arent one of the first 10 people you can reach out to him to ask for any other tax professionals David might recommend/places to find tax professionals for your area that can handle crypto taxes.